Why Don’t Americans Save More Money?

Maybe the only way to make people richer in the long run is to take their money away from them.

It is a myth that Americans cannot save. For decades, they did.

When personal-finance columnists explain America’s poor saving habits, they sometimes start with the aspects of the human mind that make it challenging to plan for the future. Behavioral psychology is a useful scapegoat for many foibles. But the decline in savings is recent, and the human brain hasn’t evolved since the Ford administration. The bottom 90 percent of households saved 10 percent of their income in the first Reagan administration. By 2006, their savings rate was nearly negative-10 percent.

Other writers suggest that the country’s low saving rate is purely a matter of American exceptionalism. But it is also a myth that the U.S. is alone in its turn against saving in the last three decades. The personal savings rate has fallen in Canada, Germany, and Japan, as well.

Still, there is something about the U.S.: Nearly half of Americans would not be able to come up with $400 in savings in an emergency, according to a Federal Reserve study cited in The Atlantic's cover story this month. America’s poor and its middle class live on the razor’s edge of financial security through their working years and are uniquely ill-prepared for retirement. The United States finished 19th for three consecutive years in a global analysis of retirement security, behind Australia, New Zealand, Japan, South Korea, Canada, and 13 European countries.

So, why don’t Americans save money? A complete answer should take into consideration three things:

(1) Since the phenomenon is new, its cause must be new.

(2) Since the decline in savings among rich countries is global, its cause must be global.

(3) Since America’s poor and middle class are so especially ill-prepared for retirement, there must be something “special" about America.

Theory 1: Americans stopped saving when their incomes stopped growing.

The heyday of American saving was also a heyday of American income growth. This makes a lot of sense: It’s easier to save money when there’s more money to save.

Between 1960 and 1973, income per capita grew at an annual rate of 3.2 percent. But in the following two decades, its growth rate fell by half to just 1.5 percent annually. Several other countries saw similar slowdowns by the late 1980s, as well. Among almost all major industrial countries, “rates of both saving and income growth have been simultaneously declining,” the economists Barry Bosworth, Gary Burtless, and John Sabelhaus wrote in a 1991 Brookings paper. Middle-class saving fell as households spent more of their income to keep up with rising expenses, like housing and health care, and with their own expectations that earnings would eventually start growing.

But this theory isn’t complete. Real income did start growing in the U.S. in the 1990s. So, why did savings continue to plummet after that?

Theory 2: The poor and middle class went into debt to buy houses.

The 1990s turned out to be a great decade in the U.S. for income growth. But the personal saving rate fell by more than five percentage points, the most of any decade in the last half century.

What happened in the 1990s? Mortgage debt happened.

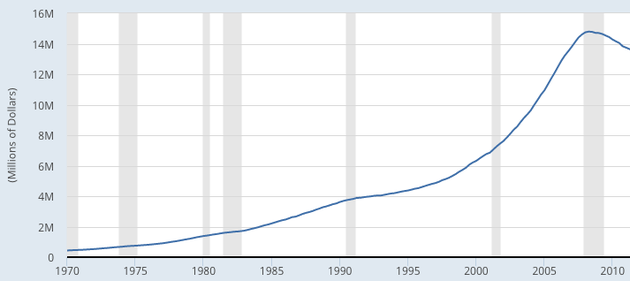

Total Mortgage Debt in the U.S., 1970-2010

The U.S. homeownership rate, which barely budged between 1985 and 1995, suddenly took off in the 1990s, peaking at an all-time high in the mid-2000s.

One plausible story is that many Americans gave up their saving habits in the stagflation ‘70s, and by the time real income growth took off in the 1990s, many of them used the credit boom to buy suburban houses, cars, and furniture. The saving rate of the bottom 90 turned negative in 1998, partly thanks to this huge rise in mortgage debt. The housing bust was painful for millions of people hit with foreclosures after the crash, and it was particularly painful for those who put most of their savings into buying houses.

Theory 3: U.S. policies make it easy to not save money.

In the last few decades, the U.S. private sector has moved from “defined benefit” retirement plans, where workers have a clear sense of how much money they'll get when they retire, to “defined contribution” plans, where workers only know how much money they're putting away each year. The 401(k) is an example of the latter.

But the 401(k) is leaky. For every $1 contributed to these plans, 40 cents flows out in the form of premature withdrawals. This is euphemistically called “flexibility,” but it in the long run it's more like unfunding one’s retirement. Countries like Germany, Australia, Canada, and the U.K., which don't allow for early withdrawals except in extreme circumstances, all perform better in measures like the retirement index.

When taken together, Theories 2 and 3 suggest that, compared to other countries, Americans don’t save money because the U.S. has made it easy to spend, easy to borrow, and easy to raid savings to spend and borrow more.

Theory 4: The U.S. is uniquely susceptible to conspicuous consumption.

In 1994, just before the housing boom pushed middle-class savings to negative levels, the economist James M. Poterba published an international study of saving rates by age. Here are his findings of personal saving rates for people under 30 around the world:

Germany 9.8

Italy 10.0

Japan: 17.9

U.K.: 5

United States: -2.2

What’s made America uniquely bad at saving? Perhaps America’s mix of wealth and diversity, the very staple of the American identity, is the culprit of its spending habits. In 2008, several researchers studied the stereotype that minorities spend more than whites on “visible goods”—like clothes, shoes, jewelry, watches, salons, health clubs, and car parts. They discovered that, even after controlling for income, minorities save less than whites and spend more on such conspicuous consumption goods. But the story wasn’t just about race. White people in poor U.S. states spent more of their income on visible goods than whites in higher income states.

One possible explanation is that people spend more to signal that they’re not poor, Megan McArdle suggested. “If you’re a member of an identifiable demographic with low average incomes (southern, racial minority, rural) you are likely to be treated as if you are poor,” which makes it harder to get both social respect and work, she wrote. In a perfectly homogenous country with all white people, there would be less reason for the poor to signal their wealth with expensive visual cues, since they already look just like the rich. But in a diverse country where some demographic groups are stereotyped as poor, lower-income people might be more likely to pay for clothes and cars that say “I’m not who you think I am.”

Theory 5: The pressure to keep up with richer neighbors has been greatly exacerbated by rising income inequality.

The average savings rate has been falling at the exact same time that income inequality has been rising. Marianne Bertrand, an economist from the Chicago Booth School of Business, and Adair Morse, from UC Berkeley's Haas School of Business, found that the trends might be related. They called their theory “trickle-down consumption”: “Households exposed to more spending by the rich self-report more financial duress,” they concluded. They even discovered a positive relationship between the income of the state’s richest households and the number of personal bankruptcies in that state. (It wasn’t just about rising home prices: Their finding was strong even after controlling for that.)

Instead, they found that conspicuous wealth was, well, contagious. When people see others living the high life, they try to buy it for themselves, even when they can’t afford it. Middle-class households in rich states shifted their spending from “non-rich goods”—gas, utilities, food at home—to “rich goods,” like clothing, jewelry, furniture, manicures, and exercise classes. If not for this shift, the non-rich would have saved an additional $800 a year in the late 2000s.

So why did the entire bottom 90 percent of the country enter a decade of negative savings? The first two answers offer an economic explanation: The American middle class made up for decades of flat wages with debt. But the last two studies offer a cultural explanation. Minorities and poor whites have spent more to signal that they are not poor, while Americans in general have spent more to signal that they are just like the rich.

America’s unique form of widespread conspicuous consumption might emerge from its public policy. The U.S. is more stratified than its peer nations, particularly when it comes to health care and education. There is no public healthcare in America, except for the old and very poor. Meanwhile, public-college costs have increased in the last few decades as public-education spending has declined at the state level.

American middle-class households pay fewer taxes and save less money than those in many other rich countries. This initially seems paradoxical, since they have more post-tax money to save. But maybe these two facts are intertwined. Perhaps it’s precisely because American policy has embraced free markets over egalitarianism that many Americans spend more to signal their prosperity, to separate themselves from their peer groups, and to show that they are better than equal.

There is a tendency for some to say that Americans don’t save money because they simply can’t afford to. In many cases, this is true. The cost of healthy food and clothes for a family with several children is fixed. Housing is expensive. Medical emergencies can be financially punishing. The short-term burdens of poverty make it impossible to plan for more than a few months ahead. Two-thirds of workers are at a company that doesn't offer a retirement plan. The U.S. is unique in its large number of single parents with children. This disproportionately affects the poor: A college graduate at 29 is 30 percent more likely to be married than a peer who never finished high school. That helps to explain why nearly 60 percent of first births in lower-middle-class households are now to unmarried women.

But the poor can save more money, and it’s not offensive to suggest so. It’s clear that millions of lower-income people can collectively devote tens of billions of dollars to an investment vehicle that holds the promise of future wealth. They already do: The lottery is a $70 billion government-financing initiative disproportionately funded by the poor. This is politically vile, but it is also an indication that low-income people see lotteries as a kind of savings vehicle. Rather than put $200 per year away in a low-risk, low-reward savings account, some put $200 into high-risk, high-reward lottery tickets.

It is crude yet important to point out that if America’s middle-class and poor were cheaper with their money, they would be richer. One fine policy would be to ban state lotteries. Another straightforward way to raise savings is to raise incomes, for example, by advocating for and enforcing a higher minimum wage. But it’s not clear that higher earnings will necessarily lead to wealth creation for the poor. In the 1990s, after all, rising incomes were plowed into homes that eventually destroyed the savings of many poor and middle class families.

In a world obsessed with the wizardry of behavioral nudges, perhaps policymakers should consider putting away the magic wand and just do the paternalistic thing: Force people to save more, by expanding Social Security or by creating new forced savings policies. It should be harder for Americans to not have financial security when they retire. Indeed, the countries that finish above the U.S. in retirement security, like Switzerland and Norway, not only have much higher taxes but also benefit from the availability of public-health options and cheaper education in their prime-age years, which means they don’t have to spend as much out of pocket on insurance and college. In Germany, social-insurance programs provide for medical care and an even more substantial level of retirement pension. It sounds counterintuitive and nearly paradoxical, but maybe the only way to make Americans richer in the long run is to take more money away from them.